A non-sterling transaction fee of 2.95% of the transaction value (in pounds).Payment Scheme Exchange Rate Indicative rates can be found at Use your credit card abroad wherever you see the Mastercard® logoįees apply when you use your card abroad: Our Internet Banking website lets you check your latest balance, search your statements and apply for new accounts Take control of your account with our mobile app

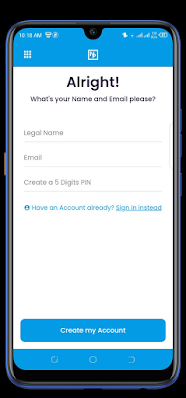

CREATE A FREE CREDIT CARD HOW TO

Although, it is convenient to have your card and savings bank account from the same bank for ease of bill payments.Choose how to manage your account - online, by phone or at a TSB branch “The consumers should lay more emphasis on the suitability and utility of various benefits offered by the card, than waive off on annual fees during the card selection process,” says Sahil Arora, Senior Director at you are applying for a fresh credit card, there is no compulsion in applying for one from the bank where you have your savings account. But, new applicants will not get this card due to ban on Mastercard for issuing new cards.įurther, BFSL does not have co-branded card options, specific types of cards such as fuel cards, shopping cards, travel cards etc. At present, premium card BOB Eterna is the only card worth holding which has multiple rewards continued. Check out other features, lifestyle or travel benefits that a card offers and see if it suits you.

CREATE A FREE CREDIT CARD FREE

This only reiterates that just a lifetime free feature on your card is not the only reason why you should subscribe to any credit card. While BFSL's changing of several features does come too soon after it had rolled out life-time free credit cards, its spokesperson says BFSL had informed customers a month before the effective date, as required by RBI. Should you continue with BOB credit cards? While this measure might sound a bit harsh, it instills discipline among credit card users and nudges them to pay their bills on time. From September 15, it is being increased to 2.5 percent of the amount over and above the sanctioned credit limit or Rs 600, whichever is higher. The charges are 2.5 percent of the amount over and above the sanctioned credit limit or Rs 500, whichever is higher. In case you exceed the credit limit there are bank charges applicable. If you have more than Rs 50,001 due, then your new late payment penalty will be Rs 1,300.

From September 15, this charge would be Rs 1,100, if you have between Rs 25,001 and Rs 50,000 as dues. The bank has increased the late payment charges for the higher due amount.įor instance, if more than Rs 25,000 is due on your credit card statement, your BOB cards bank charges Rs 950 at present. Increase in charges applicable to all credit cardsĪ late payment fees is charged by the bank on all credit cards if the minimum amount on the statement is not paid by the due date. With effect from September 15, the bank has withdrawn this bonus reward point benefit on this card. This is in addition to the usual reward points you earn for every transaction. One of the main features of BOB’s Select credit card is that it allows you to earn 1,000 bonus reward points on five transactions of more than Rs 1,000 per month. This charge is levied when you un-block a credit card, after blocking it earlier. The good news is that BFSL has removed the de-blocking charge, which was earlier Rs 300. She adds: "The 5x Rewards range of BoB Credit Cards continues to offer several benefits to the cardholders, by way of accelerated rewards, relevant merchant offers, instalment programs and various other benefits."Īlso read: Citibank to sell credit cards business: Should you use your card, will your credit score be hit-all your questions answered The is not a downgrade it's merely a revision of features," says a BoB spokesperson. "These revisions in credit card features, benefits and charges are routinely done by all credit card issuers, depending on various factors including competition and incremental value added to the customer and/ or portfolio. In case you have accumulated reward points on these credit cards, you can still redeem them before September 15 at the existing rates before they get revised. Effective from September 15, the redemption value of 1 point has gone down to 20 paise on Easy and Swavlamban credit cards. In simple words, one reward point used to earn you items worth 25 paise. Or you can even use them to pay your card dues.Īt present, the redemption value of one reward point is 25 paise. After you accumulate a chunk of such reward points, you can redeem them to buy items of your choice. When you swipe the credit card for shopping from stores or online, you earn the reward points.

RBI announcement: Limit raised for IMPS, ombudsmen mandated for NBFCs

India Inc On The Move Sustainability 100+.

CREATE A FREE CREDIT CARD SERIES

0 kommentar(er)

0 kommentar(er)